$19.99 Original price was: $19.99.$14.79Current price is: $14.79.

- Buy with Peace of Mind

- Safe Transactions, Happy Customers

- Shop with Confidence, Pay Safely

- High quality products, low prices.

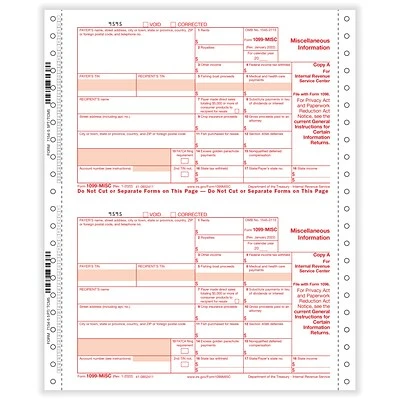

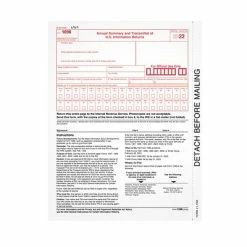

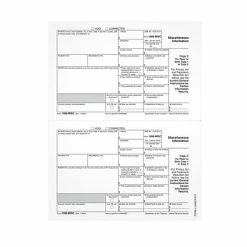

File form 1099-MISC for each person in the course of your business to whom you have paid the following during the year: at least $10 in royalties or broker payments in lieu of dividends or tax-exempt interest; at least $600 in rents, prizes, and awards; any fishing boat proceeds; medical and health -are payments; and various other income payments including, but not limited to, those to an attorney or nonqualified deferred compensation. You must also file form 1099-MISC for each person from whom you have withheld any federal income tax under the backup withholding rules, regardless of the amount of the payment.

-

File form 1099-MISC for each person in the course of your business to whom you have paid during the year

-

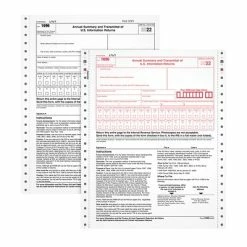

5-part, 2-up: Copies A/State/B/C/2

-

For continuous printers

-

Pack contains 25 tax forms

-

Dimensions: 9″ x 11″

| Acid Free | Non |

|---|---|

| Brand | ComplyRight |

| Customizable | No |

| Length in Inches | 11 |

| Pack Qty | 25 |

| Parts | 5 |

| Tax Form Pack Size | 25 |

| Tax Form Type | 1099 |

| Tax Forms Number of Recipient or Employees | 1-25 |

| True Color | White/Red |

| Width in Inches | 9 |

| Year | 2022 |

Be the first to review “Cheapest 😉 Tax Forms ComplyRight 1099-MISC Copies A/State/B/C/2 Tax Form Set, 25/Pack (7154525) 🎉” Cancel reply

Related products

Sale!

Sale!

1099 Miscellaneous Forms for Laser Printers

Sale!

Sale!

Sale!

Tax Forms

Best reviews of 😀 Tax Forms ComplyRight 1098 Copies A, B, C Tax Form Set, 10/Pack (6108E10) 😉

Sale!

Sale!

Sale!

Tax Forms

Buy 🛒 W-2 Individual Forms TOPS 2022 W-2 Tax Form, 1-Part Copy B, White, 100 Forms/Pack (LW2EEBQ) 🧨

Reviews

There are no reviews yet.