$21.99 Original price was: $21.99.$14.29Current price is: $14.29.

- Buy with Peace of Mind

- Safe Transactions, Happy Customers

- Shop with Confidence, Pay Safely

- High quality products, low prices.

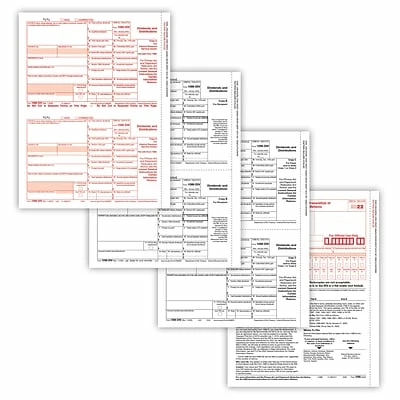

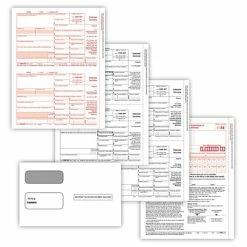

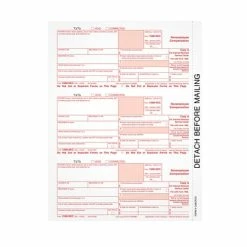

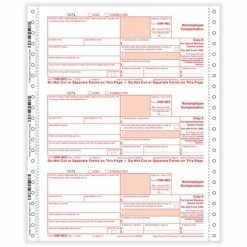

File form 1099-DIV for each person: to whom you have paid dividends (including capital gain dividends and exempt-interest dividends) and other distributions on the stock of $10 or more; for whom you have withheld and paid any foreign tax on dividends and other distributions on stock; for whom you have withheld any federal income tax on dividends under the backup withholding rules; or to whom you have paid $600 or more as part of a liquidation. Four-part.

-

File form 1099-DIV for each person: to whom you have paid dividends (including capital gain dividends and exempt-interest dividends), and other distributions

-

Consists of four parts: Copies A, B, C and/or State

-

For laser printers

-

Pack contains 10 tax forms

-

Dimensions: 8.5″ x 11″

| Acid Free | Non |

|---|---|

| Brand | ComplyRight |

| Customizable | No |

| Length in Inches | 11 |

| Pack Qty | 10 |

| Parts | 4 |

| Tax Form Pack Size | 10 |

| Tax Form Type | 1099 |

| Tax Forms Number of Recipient or Employees | 1-25 |

| True Color | White/Red/Black |

| Width in Inches | 8.5 |

| Year | 2022 |

Be the first to review “Budget 🥰 Tax Forms ComplyRight 2022 1099-DIV Copies A, B, C And/or State Tax Form Set, 10/Pack (610710) 🎉” Cancel reply

Related products

Sale!

Tax Forms

Budget 🤩 Tax Forms ComplyRight 2022 1099-INT Copies A, B, C Tax Form Set, 10/Pack (6106E10) 🎉

Sale!

Sale!

Tax Forms

Cheap ✨ Tax Forms TOPS 2022 1098 Mortgage Interest Laser Forms, 50 Forms/Pack (L1098FED-S) ⌛

Sale!

Sale!

Tax Forms

New 🔔 Tax Forms ComplyRight 2022 1099-NEC Copies A/State/B/C/2 Tax Form Set, 25/Pack (NEC7154525) ⭐

Sale!

Tax Forms

Best deal 🤩 Tax Forms TOPS 2021 Blank W-2 2-Down Style Tax Form Cut Sheets, 50/Pack (BLW2-S) 🧨

Sale!

Sale!

Perforated Blank Forms

Reviews

There are no reviews yet.