$8.79 Original price was: $8.79.$5.89Current price is: $5.89.

- Buy with Peace of Mind

- Safe Transactions, Happy Customers

- Shop with Confidence, Pay Safely

- High quality products, low prices.

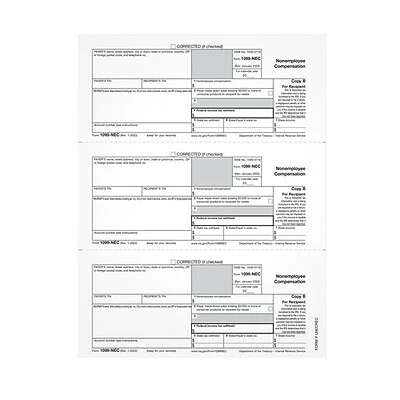

This TOPS® tax forms pack gives you 50 1099-NEC Copy B micro perforated sheets.

Use TOPS 1099-NEC tax forms to report miscellaneous income. 1099 tax forms are used to report rents, royalties, prizes and awards, fishing boat proceeds, fees, commissions paid to non-employees, receipts of medical and health care payments, and substitute payments in lieu of dividends or interest.

Use TOPS 1099-NEC tax forms to report miscellaneous income. 1099 tax forms are used to report rents, royalties, prizes and awards, fishing boat proceeds, fees, commissions paid to non-employees, receipts of medical and health care payments, and substitute payments in lieu of dividends or interest.

-

Form 1099-NEC records all nonemployee compensation to the IRS and recipients, replacing Box 7 on the 1099-MISC

-

Recipient Copy B laser cut sheet form

-

Tax forms are inkjet and laser printer compatible

-

Contains 50 forms per pack

-

Dimensions: 8.5″W x 11″L

-

White sheets are printed in black ink with back printing in gray ink

-

The 2022 1099-NEC must be mailed or e-filed to the IRS and furnished to your recipients by February 1, 2022

-

Acid-free paper and heat-resistant inks produce smudge-free, archival-safe records

-

Meets or exceeds IRS specifications

-

Accounting software and QuickBooks compatible

Use TOPS 1099-NEC tax forms to report miscellaneous income. 1099 tax forms are used to report rents, royalties, prizes and awards, fishing boat proceeds, fees, commissions paid to non-employees, receipts of medical and health care payments, and substitute payments in lieu of dividends or interest.

| Acid Free | |

|---|---|

| Brand | TOPS |

| Customizable | No |

| Height in Inches | 11 |

| Length in Inches | 11 |

| Pack Qty | 50 |

| Quick Ship | Yes |

| Recycled Content (%) | 0 |

| Tax Form Pack Size | 50 |

| Tax Form Type | 1099 |

| Tax Forms Number of Recipient or Employees | 26-50 |

| True Color | White |

| Width in Inches | 8.5 |

| Year | 2022 |

Be the first to review “Top 10 ⌛ Tax Forms TOPS 2022 1099-NEC Copy B Tax Form, White, 50 Forms/Pack (LNECREC-S) 🎁” Cancel reply

Related products

Sale!

1099 Miscellaneous Forms for Laser Printers

Sale!

Sale!

Sale!

Tax Forms

Best reviews of 😀 Tax Forms ComplyRight 1098 Copies A, B, C Tax Form Set, 10/Pack (6108E10) 😉

Sale!

Perforated Blank Forms

Sale!

Sale!

Tax Forms

Budget 🤩 Tax Forms ComplyRight 2022 1099-INT Copies A, B, C Tax Form Set, 10/Pack (6106E10) 🎉

Sale!

Reviews

There are no reviews yet.