$97.99 Original price was: $97.99.$74.47Current price is: $74.47.

- Buy with Peace of Mind

- Safe Transactions, Happy Customers

- Shop with Confidence, Pay Safely

- High quality products, low prices.

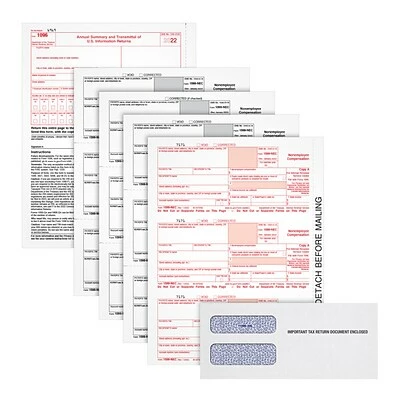

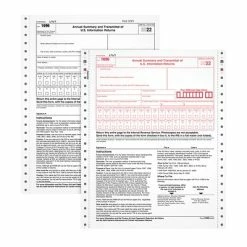

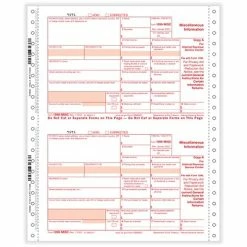

For over 35 years TOPS has been helping companies fulfill their tax and business form needs. The 1099-NEC forms can be used to report rents, royalties, prizes and awards, fishing boat proceeds, fees, commissions paid to non-employees, receipts of medical and health care payments. The years of experience working closely with the IRS guarantees the accuracy of all specifications and IRS compliance. As a result, the standards are set for excellence in service and product quality. For trusted accuracy and compliance with all of your tax form requirements, choose TOPS, the industry leader.

-

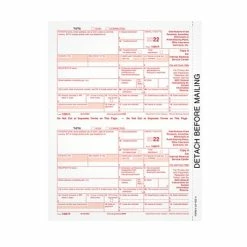

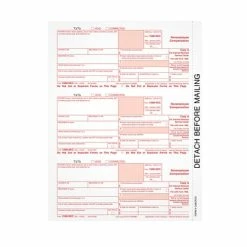

Form 1099-NEC records all nonemployee compensation to the IRS and recipients, replacing Box 7 on the 1099-MISC

-

Five-part tax forms

-

Tax forms are inkjet and laser printer compatible

-

Pack contains 102 1099-NEC forms, 100 envelopes

-

Product dimensions: 11″H x 8.5″W

-

The new 1099-NEC will capture any payments to nonemployee service providers, such as: independent contractors, freelancers, vendors, consultants and other self-employed individuals (commonly referred to as 1099 workers

-

The 2022 1099-NEC must be mailed or e-filed to the IRS and furnished to your recipients by February 1, 2022

-

Acid-free paper and heat-resistant inks produce smudge-free, archival-safe records

-

Meets or exceeds IRS specifications

-

Accounting software and QuickBooks compatible

For over 35 years TOPS has been helping companies fulfill their tax and business form needs. The 1099-NEC forms can be used to report rents, royalties, prizes and awards, fishing boat proceeds, fees, commissions paid to non-employees, receipts of medical and health care payments. The years of experience working closely with the IRS guarantees the accuracy of all specifications and IRS compliance. As a result, the standards are set for excellence in service and product quality. For trusted accuracy and compliance with all of your tax form requirements, choose TOPS, the industry leader.

| Acid Free | |

|---|---|

| Brand | TOPS |

| Customizable | No |

| Height in Inches | 2.1 |

| Length in Inches | 11 |

| Pack Qty | 100 |

| Parts | 5 |

| Quick Ship | Yes |

| Tax Form Pack Size | 100 |

| Tax Form Type | 1099 |

| Tax Forms Number of Recipient or Employees | 51+ |

| True Color | White |

| Width in Inches | 8.5 |

| Year | 2022 |

Be the first to review “Buy 🥰 TOPS 2022 1099-NEC 4-Part Tax Forms, Envelopes & Software, 100 Sets/Pack (LNEC5WSKIT-S) 🔥” Cancel reply

Related products

Tax Forms

Cheap ✨ Tax Forms TOPS 2022 1098 Mortgage Interest Laser Forms, 50 Forms/Pack (L1098FED-S) ⌛

Tax Forms

Cheapest 😉 Tax Forms ComplyRight 1099-MISC Copies A/State/B/C/2 Tax Form Set, 25/Pack (7154525) 🎉

Reviews

There are no reviews yet.