$10.99 Original price was: $10.99.$8.46Current price is: $8.46.

- Buy with Peace of Mind

- Safe Transactions, Happy Customers

- Shop with Confidence, Pay Safely

- High quality products, low prices.

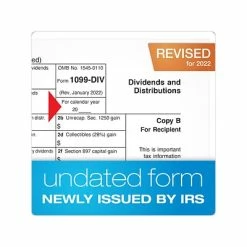

The five-part Adams 1099-DIV form for reporting dividends and distributions. The Adams 1099-DIV form is microperforated with two forms per page.

-

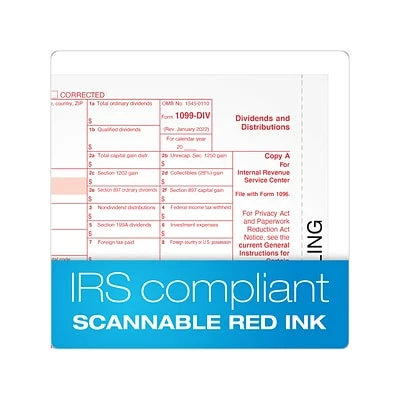

Use the form 1099-DIV to report gross dividends and other distributions

-

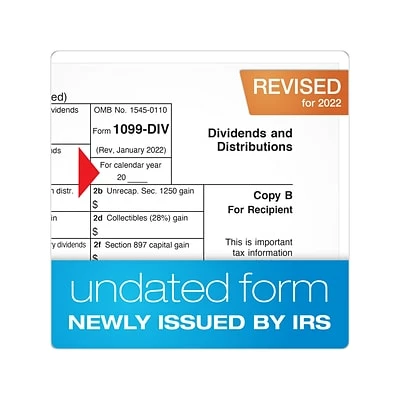

For paper filers, the 2022 1099-DIV (Copy B) is due to your recipients by January 31, 2023; Copy A and 1096 are due to the IRS by February 28, 2023 or e-File by March 31, 2023

-

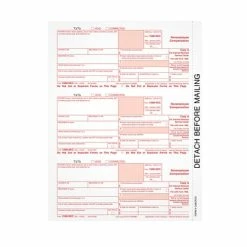

Five-part 1099-DIV forms print two to a page on five microperforated sheets with Copies A, C/1, B, 2, and C/1

-

Inkjet and laser printer compatible

-

Pack contains 10 1099-DIV form sets

-

As of 2022, the IRS has made the 1099-DIV a continuous-use form with a new fill-in-the-year date field good for multiple tax years; the previously unnumbered FATCA box is now box 11 on the 1099-DIV and remaining boxes have been renumbered

-

Sheet size: 8.5″ x 11″; detached size: 5.5″ x 8.5″

-

White form has a scannable red ink Copy A required by the IRS for paper filing

-

Acid-free paper and heat-resistant inks produce smudge-free, archival-safe records

-

Meets or exceeds the IRS standard

-

Online tax software and 1096 summary forms sold separately

-

Compatible with QuickBooks, Adams Tax Forms Helper, and other accounting and tax software programs

-

Don’t forget to add two-up 1099 envelopes (not included)

| Acid Free | |

|---|---|

| Brand | Adams |

| Customizable | No |

| Height in Inches | 11 |

| Pack Qty | 10 |

| Parts | 5 |

| Quick Ship | Yes |

| Tax Form Pack Size | 10 |

| Tax Form Type | 1099 |

| Tax Forms Number of Recipient or Employees | 25-Jan |

| True Color | White |

| Width in Inches | 8.5 |

| Year | 2022 |

Be the first to review “Best Pirce 🛒 W-2 Individual Forms Adams 2022 1099-DIV Tax Form, White, 10/Pack (STAX5DV-22) 👍” Cancel reply

Related products

Sale!

Sale!

Sale!

Sale!

1099 Miscellaneous Forms for Laser Printers

Sale!

Sale!

Tax Forms

Budget 🤩 Tax Forms ComplyRight 2022 1099-INT Copies A, B, C Tax Form Set, 10/Pack (6106E10) 🎉

Sale!

Sale!

Tax Forms

Best reviews of 😀 Tax Forms ComplyRight 1098 Copies A, B, C Tax Form Set, 10/Pack (6108E10) 😉

Reviews

There are no reviews yet.