$14.79 Original price was: $14.79.$10.94Current price is: $10.94.

- Buy with Peace of Mind

- Safe Transactions, Happy Customers

- Shop with Confidence, Pay Safely

- High quality products, low prices.

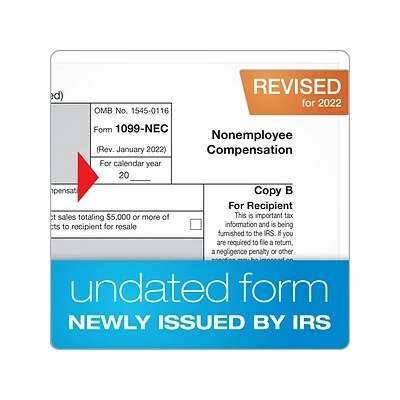

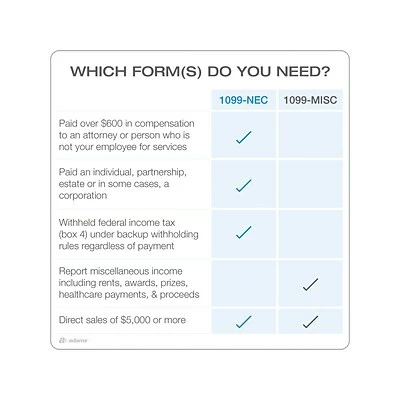

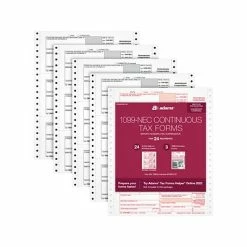

Use this Adams 2022 form 1099-NEC to report nonemployee compensation paid to independent contractors, freelancers, sole proprietors, and the self-employed and/or payer-made sales of $5000 or more. Get the 2022 IRS form 1099-NEC on continuous feed paper for pin-fed dot matrix printers.

-

Use the form 1099-NEC to report nonemployee compensation paid to independent contractors

-

Must be mailed or e-Filed to the IRS and furnished to your recipients by January 31, 2023

-

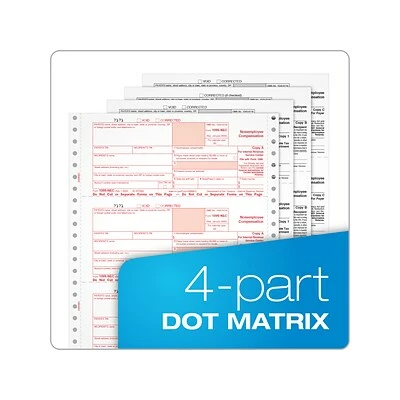

Five-part 1099-NEC carbonless forms print three to a page on eight microperforated sheets with Copies A, 1, B, 2, and C

-

Compatible with dot matrix printers

-

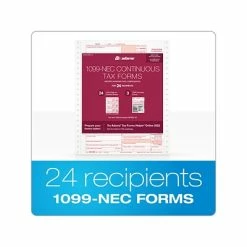

24 1099-NEC continuous pin-fed form sets and three 1096 summary forms per pack

-

Sheet size: 9″ x 11″; detached size: 8.5″ x 3.67″

-

White forms have scannable red ink Copy A and 1096 required by the IRS for paper filing

-

Acid-free paper and heat-resistant inks produce smudge-free, archival-safe records

-

Meets the IRS specifications

-

Compatible with QuickBooks, Adams Tax Forms Helper, and other accounting and tax software programs

-

Online tax software sold separately

-

Three-up 1099 forms require envelopes for mailing (not included)

| Acid Free | |

|---|---|

| Brand | Adams |

| Customizable | No |

| Length in Inches | 11 |

| Pack Qty | 24 |

| Parts | 5 |

| Quick Ship | Yes |

| Tax Form Pack Size | 24 |

| Tax Form Type | 1099 |

| Tax Forms Number of Recipient or Employees | 25-Jan |

| True Color | White |

| Width in Inches | 9 |

| Year | 2022 |

Be the first to review “Discount 🧨 W-2 Individual Forms Adams 2022 1099-NEC Tax Form, White, 24/Pack (STAX524NEC-22) 🌟” Cancel reply

Related products

Sale!

Sale!

1099 Miscellaneous Forms for Laser Printers

Sale!

Sale!

Sale!

Tax Forms

Best reviews of 😀 Tax Forms ComplyRight 1098 Copies A, B, C Tax Form Set, 10/Pack (6108E10) 😉

Sale!

Sale!

Sale!

Tax Forms

Best deal 🤩 Tax Forms TOPS 2021 Blank W-2 2-Down Style Tax Form Cut Sheets, 50/Pack (BLW2-S) 🧨

Reviews

There are no reviews yet.