$26.99 Original price was: $26.99.$19.16Current price is: $19.16.

- Buy with Peace of Mind

- Safe Transactions, Happy Customers

- Shop with Confidence, Pay Safely

- High quality products, low prices.

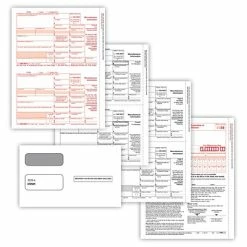

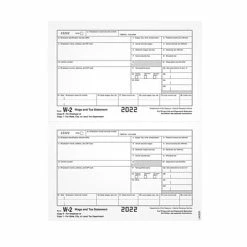

Get the Adams 1099-NEC form you need to report nonemployee compensation paid to independent contractors. Includes access to Tax Forms Helper Online and 10 Federal e-Files.

-

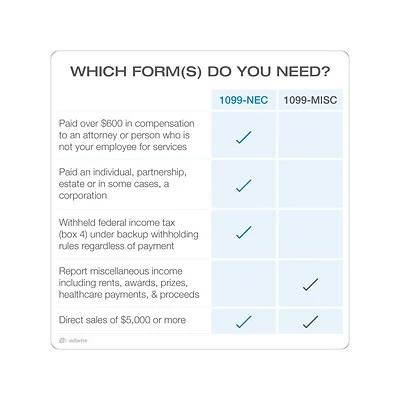

Use the form 1099-NEC to report nonemployee compensation paid to independent contractors

-

Must be mailed or e-Filed to the IRS and furnished to your recipients by January 31, 2023

-

Five-part 1099-NEC forms print three to a page on 17 microperforated sheets with Copies A, C/1, B, 2, and C/1

-

Inkjet and laser printer compatible

-

Pack contains 50 1099-NEC form sets, three 1096 summary forms, and Tax Forms Helper Online 2022 (access code and password included in your package)

-

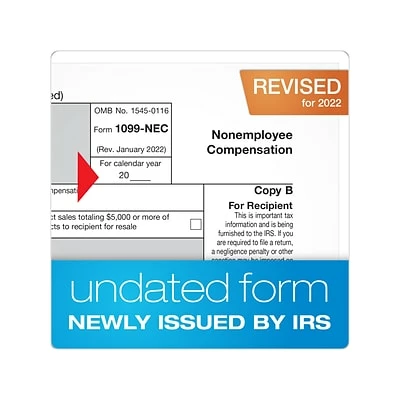

As of 2022, the IRS has made the 1099-NEC a continuous-use form with a new fill-in-the-year date field good for multiple tax years

-

Sheet size: 9″ x 11″; detached size: 8.5″ x 3.67″

-

White form has a scannable red ink Copy A and 1096 required by the IRS for paper filing

-

Acid-free paper and heat-resistant inks produce smudge-free, archival-safe records

-

Meets or exceeds the IRS standard

-

Log in to Tax Forms Helper and get 10 Federal e-Files from Adams Tax Forms, an authorized e-File provider

-

Now with QuickBooks Connector for seamless integration with QuickBooks Online

-

Don’t forget to add three-up 1099 envelopes (not included)

-

Use CSV files for compatible imports from QuickBooks Desktop or other common accounting software programs

| Acid Free | Acid free |

|---|---|

| Brand | Adams |

| Customizable | No |

| Height in Inches | 11 |

| Pack Qty | 50 |

| Parts | 5 |

| Quick Ship | Yes |

| Tax Form Pack Size | 50 |

| Tax Form Type | 1099 |

| Tax Forms Number of Recipient or Employees | 26-50 |

| True Color | White |

| Width in Inches | 9 |

| Year | 2022 |

Be the first to review “Buy ✨ W-2 Individual Forms Adams 2022 1099-NEC Tax Form, White, 50/Pack (STAX550NEC-22) 🔔” Cancel reply

Related products

Sale!

Sale!

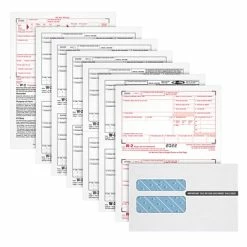

1099 Miscellaneous Forms for Laser Printers

Sale!

1099 Miscellaneous Forms for Laser Printers

Sale!

Sale!

Perforated Blank Forms

Sale!

Sale!

Tax Forms

Cheap ✨ Tax Forms TOPS 2022 1098 Mortgage Interest Laser Forms, 50 Forms/Pack (L1098FED-S) ⌛

Sale!

Reviews

There are no reviews yet.