$13.79 Original price was: $13.79.$8.96Current price is: $8.96.

- Buy with Peace of Mind

- Safe Transactions, Happy Customers

- Shop with Confidence, Pay Safely

- High quality products, low prices.

Make quick work of 2022 taxes with the Adams 1099-R tax form. Use the form 1099-R to report distributions over $10 from pensions, annuities, retirement or profit-sharing plans, IRAs, insurance contracts, and other sources to the IRS and recipients

-

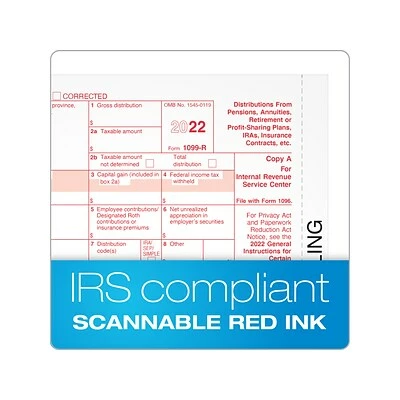

Use the form 1099-R to report distributions over $10 from pensions, annuities, retirement or profit-sharing plans, IRAs, insurance contracts, and other sources to the IRS and recipients

-

For paper filers, the 1099-R Copies B, C, and 2 are due to your recipients by Jan. 31, 2023; Copy A and 1096 are due by Feb. 28 or e-File by Mar. 31, 2023

-

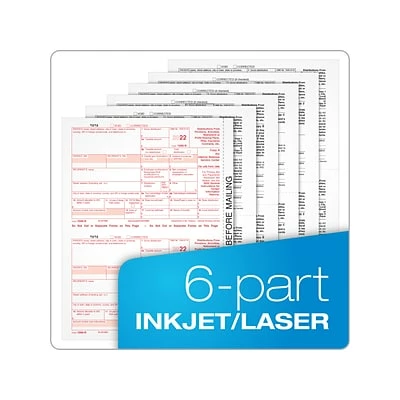

Six-part 1099-R form prints two to a page on five microperforated sheets with Copies A, D/1, B, C, 2, and D/1

-

Inkjet and laser printer compatible

-

Pack contains 10 1099-R tax form sets

-

Sheet size: 8.5″ x 11″; detached size: 5.5″ x 8.5″

-

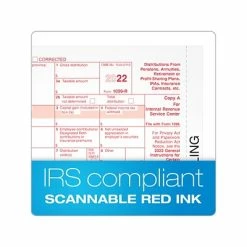

White form has scannable red ink Copy A required by the IRS for paper filing

-

Acid-free paper and heat-resistant ink produce smudge-free, archival-safe records

-

Meets the IRS standards

-

Compatible with QuickBooks, Adams Tax Forms Helper, and other accounting and tax software programs

-

Online tax software sold separately

-

Don’t forget to add two-up 1099 envelopes (not included)

| Acid Free | |

|---|---|

| Brand | Adams |

| Customizable | No |

| Length in Inches | 11 |

| Pack Qty | 10 |

| Parts | 6 |

| Quick Ship | Yes |

| Tax Form Pack Size | 10 |

| Tax Form Type | 1099 |

| Tax Forms Number of Recipient or Employees | 25-Jan |

| True Color | White |

| Width in Inches | 8.5 |

| Year | 2022 |

Be the first to review “Flash Sale ⭐ W-2 Individual Forms Adams 2022 1099-R Tax Form, White, 10/Pack (STAX5R-22) ⌛” Cancel reply

Related products

Sale!

Sale!

Sale!

Sale!

Sale!

Sale!

Sale!

Perforated Blank Forms

Sale!

Reviews

There are no reviews yet.